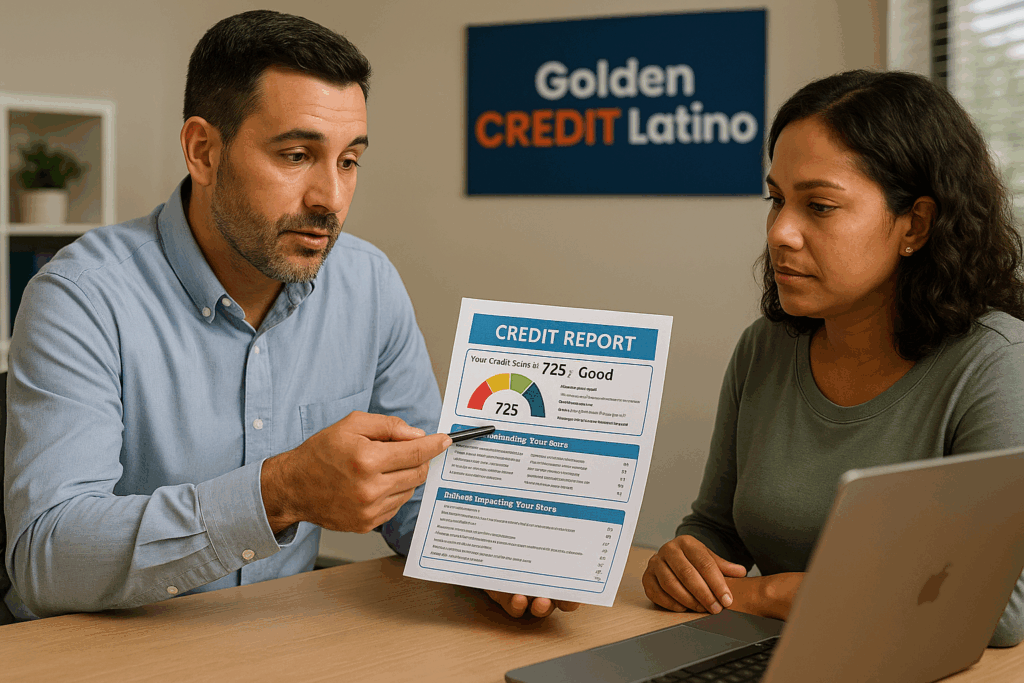

Credit Repair Fixes Your Score and Opens New Opportunities

Is your credit score standing in the way of your financial goals? Whether you’re trying to qualify for a mortgage, secure better interest rates, or finally break free from debt, your credit score plays a significant role. At Golden Credit Latino in Dania Beach, FL, we specialize in professional credit repair services that correct damaging errors, improve your score, and unlock new opportunities for your future. Bad Credit Doesn’t Have to Be Permanent A low credit score can feel like a life sentence, but it’s not. Inaccurate late payments or accounts you never opened on your credit report may unfairly lower your score. Many people are surprised to learn that these errors are both common and correctable. By taking action to remove them, you’re not just fixing a number; you’re also addressing the underlying issue. You’re clearing a path to financial freedom. What Happens When You Dispute Credit Errors the Right Way Credit repair isn’t just about sending letters to credit bureaus. It’s a strategic, multi-step process. At Golden Credit Latino, we take a hands-on approach that includes: Our experts know what to look for and how to act fast. That way, you don’t waste time with generic online templates or guesswork. Clean Credit Leads to Real-World Wins Raising your score doesn’t just boost your confidence; it also enhances your overall well-being. It can completely change your financial landscape. Some of the most life-changing benefits our clients experience include: Clean credit opens the door to choices that were once out of reach. Why Dania Beach Residents Trust Golden Credit Latino In a world full of credit repair scams and false promises, local trust matters. Golden Credit Latino stands apart with: We take pride in offering our services to Dania Beach and its surrounding communities with honesty, care, and a long-term commitment. Whether you’re seeking credit repair, debt relief, or financial counseling, you’ll find personalized support every step of the way. Ready to Turn Your Credit Around? You don’t have to live with the weight of a low credit score. If you’re ready to change your financial outlook, we’re here to help. From disputing errors to building long-term credit habits, Golden Credit Latino will support you every step of the way. Take the first step now and start building a better financial future.Contact us today to schedule your free credit consultation, or visit our blog for more tips on credit, debt management, and financial growth.

Debt Relief Services Offer Solutions for Financial Freedom

Debt can quickly feel overwhelming. Bills pile up, interest adds more pressure, and it can feel like there’s no way out. That’s where debt relief services can help. Golden Credit Latino in Dania Beach, FL, helps individuals take control of their finances through debt consolidation and debt settlement. If you’re struggling with payments, we offer real solutions to help you move forward. Why People Need Debt Relief Services Many people deal with credit card debt, high-interest loans, or surprise expenses. These financial problems can cause stress, worry, and sleepless nights. Debt relief services offer innovative ways to lower what you owe and make payments more straightforward to manage. Whether you need to combine debts into one payment or talk to lenders about reducing your balance, our team is here to support you. What Is Debt Consolidation? Debt consolidation involves consolidating multiple debts into a single monthly payment. It can help you stay organized and pay less interest over time. At Golden Credit Latino, we look at your whole financial situation and help you choose the best option. Our team works with clients in Dania Beach and nearby areas to find the right plan. You’ll have fewer bills to track and a clear plan to pay off your debts. Benefits of Debt Consolidation: What Is Debt Settlement? If you’ve missed payments or have bills in collections, debt settlement may be a better choice. It means talking with lenders to reduce the amount you owe. You’ll pay a smaller amount, either all at once or over time. Golden Credit Latino has experience working with lenders to reach fair agreements. This way, you can avoid bankruptcy and still make real progress toward being debt-free. Debt Settlement Can Help If: Planning for a Strong Financial Future Getting out of debt is only part of the process. You also need a plan to stay on track. That’s why we offer financial counseling to help you build smart habits. We’ll help you understand your income, spending, and credit. Whether you want to fix your credit or create a better budget, our team is ready to guide you. Why Dania Beach Trusts Golden Credit Latino Golden Credit Latino is proud to serve Dania Beach, FL, and the surrounding community. Our clients trust us because we treat every situation with care and respect. We don’t use one-size-fits-all programs. Instead, we create custom plans based on your needs. You can count on us to be honest, private, and supportive. We’re here to help you feel confident about your money again. Take the First Step Toward Financial Freedom You don’t have to face debt alone. If you’re feeling stressed about bills or unsure how to improve your credit, now is the time to take action. Golden Credit Latino in Dania Beach, FL, is ready to help you regain control.Contact us today to schedule a free consultation and learn how we can support you. For helpful tips and updates, visit our blog to learn more about managing debt and improving your finances.

Financial Counseling Provides Smart Strategies for Debt Relief

Golden Credit Latino offers expert financial counseling in Dania Beach, FL, designed to help individuals and families take control of their money, reduce debt, and build a stable financial future. Life doesn’t always go as planned—unexpected bills, job changes, or high-interest credit card debt can cause stress and strain your monthly budget. That’s where we come in. Our team delivers innovative, personalized strategies that make it easier to manage your debt, rebuild your credit, and plan confidently. Your Partner in Financial Stability At Golden Credit Latino, financial counseling goes beyond advice—it’s a partnership focused on long-term results. We understand how challenging it can be to face economic hardship alone. We build our services on trust, transparency, and proven solutions. Each client receives a customized action plan tailored to their goals and challenges. Whether you’re falling behind on payments or looking for guidance on how to avoid future debt, we’re here to help you move forward. Our counselors specialize in budgeting, debt relief, and financial planning. We take the time to understand your complete financial picture and then guide you step-by-step through solutions that reduce stress and improve your quality of life. Budgeting Support and Expense Planning Effective budgeting is the foundation of financial recovery. If you’ve never created a budget or find it challenging to stick to one, our team will work closely to develop a spending plan that aligns with your income, obligations, and lifestyle. We identify where you can cut expenses, prioritize payments, and gradually build savings—even when money feels tight. By creating a realistic budget, you gain control over your daily finances and can make smarter decisions about where your money goes. With better insight into your spending, you’ll feel more confident about meeting both short-term needs and long-term goals. Debt Management That Makes a Difference Managing multiple debts from credit cards, medical bills, or loans can feel overwhelming. Our debt management services simplify repayment by consolidating debts into one affordable monthly payment. In many cases, we can negotiate lower interest rates and eliminate excessive fees, making it easier to stay on track. Golden Credit Latino works directly with creditors to ensure the best possible outcome for your situation. Our goal is to reduce your debt and help you regain financial stability and peace of mind. You’ll see real progress toward becoming debt-free through a structured repayment plan. Planning for a Better Financial Future Financial counseling isn’t only for people in crisis. Many clients come to us for guidance on improving their financial habits, saving for big purchases, or preparing for unexpected challenges. Our advisors offer practical tools for financial planning, including credit improvement strategies, emergency fund development, and long-term savings goals. Everyone deserves access to the tools and support needed to make informed financial decisions. With the proper knowledge and a clear plan, economic freedom is possible, no matter where you’re starting from. Serving Dania Beach, FL, and Beyond Based in Dania Beach, FL, Golden Credit Latino proudly serves our local community and surrounding areas with integrity and compassion. Our bilingual team is experienced and committed to helping you find the best solutions for your unique financial situation. We take pride in being a trusted resource for financial counseling and debt relief services, delivering expert support with a human touch. We’re here to walk with you if you’re ready to take the first step toward financial control. Whether you need help managing debt, improving your credit, or planning for the future, our team is ready to support you every step of the way. Check out our blog for helpful tips, financial insights, and expert advice on controlling your finances.Contact Golden Credit Latino today to schedule a consultation and build a stronger financial future.

Debt Settlement Lowers What You Owe Through Negotiation

When you’re drowning in debt, making minimum payments every month can feel like you’re getting nowhere. High interest rates, late fees, and mounting balances worsen things. But there’s a solution that doesn’t involve bankruptcy—debt settlement. At Golden Credit Latino in Dania Beach, FL, we help clients reduce their debts by negotiating directly with creditors. If you’re ready for a realistic path toward financial relief, debt settlement could be the turning point. What Is Debt Settlement? Debt settlement is a financial strategy that allows you to pay less than you owe. Rather than paying off your entire balance, our team works with your creditors to settle your debt for a reduced lump sum or a more affordable payment plan. In many cases, creditors are willing to accept a lower amount if they know they’ll receive something rather than risk nonpayment. This approach is constructive for those behind on payments or unable to keep up with minimum monthly dues. It’s not about avoiding your responsibilities but finding a realistic solution that works for your financial situation. How the Process Works At Golden Credit Latino, we make the debt settlement process transparent and manageable: Our goal is simple: to help you settle your debt quickly and for less than the original amount while protecting your financial future. Why Debt Settlement Works Many creditors would rather receive partial payment than nothing at all. That’s why debt settlement works—it offers a win-win outcome. You reduce your debt burden, and creditors recover part of their money. It’s important to note that debt settlement can impact your credit in the short term. However, if you’re already behind on payments or your credit score has taken a hit, the long-term benefits of reducing your debt often outweigh the temporary credit impact. And the best part? Once the settlement is complete, you’re no longer on the hook for the original full amount—freeing you to rebuild your credit and move forward confidently. Local Help You Can Trust At Golden Credit Latino in Dania Beach, FL, we understand how overwhelming debt can be. That’s why we offer compassionate, professional support every step of the way. Our experienced debt negotiators know how to work with creditors and collection agencies to secure the best possible outcomes for our clients. We serve individuals and families throughout Dania Beach and the surrounding areas, tailoring every solution to match your financial situation. Whether you’re struggling with credit card debt, personal loans, or medical bills, our team is ready to help you find relief through expert negotiation. Begin Your Journey to Relief If you’re stuck or stressed about your financial situation, know you’re not alone and have options. Debt settlement isn’t about giving up; it’s about taking control and creating a more innovative way forward. Explore our blogs to learn more about debt relief strategies, financial tips, and how settlement works.Let Golden Credit Latino in Dania Beach, FL, be your trusted partner in financial recovery. Contact us today for a free consultation and see how much we can help you save through professional debt negotiation.

Credit Counseling Guides You to Financial Stability

Managing debt and maintaining good credit can be overwhelming, but you don’t have to navigate financial challenges alone. Golden Credit Latino in Dania Beach, FL, provides expert credit counseling services to help individuals and families regain control of their finances. Whether you’re struggling with credit card debt, facing loan repayment difficulties, or simply looking for ways to improve your financial habits, credit counseling offers the guidance needed to build a stable financial future. What is Credit Counseling? Credit counseling is a professional service that helps individuals understand their financial situation and develop a structured plan to manage debt effectively. Golden Credit Latino provides tailored counseling sessions that focus on: With the right credit counseling plan, you can reduce financial stress, minimize debt, and work toward long-term economic stability. The Benefits of Credit Counseling Credit counseling is more than just advice—it’s a structured approach to eliminating debt and improving financial health. Here’s how it can help: 1. Develop a Personalized Debt Management Plan (DMP) A Debt Management Plan (DMP) offers a solution for individuals struggling to manage multiple debts, including credit cards, personal loans, medical bills, and auto loans. By consolidating these payments into a single, more manageable monthly payment, a DMP simplifies the repayment process. Credit counselors negotiate with lenders to lower interest rates and reduce fees, making it easier for borrowers to pay off their debt efficiently. 2. Improve Your Credit Score A low credit score can make qualifying for loans, renting an apartment, or securing lower interest rates challenging. Credit counseling provides strategies to rebuild credit, such as: By following a structured plan, individuals can gradually repair and strengthen their credit over time. 3. Avoid Costly Financial Mistakes Many unknowingly make financial decisions that worsen their debt situation—such as using high-interest payday loans, missing payments, or maxing out credit cards. Credit counselors educate clients on smart financial habits, ensuring they make informed choices that prevent future economic crises. 4. Reduce Stress and Financial Anxiety Debt and financial struggles can lead to stress, anxiety, and even relationship strain. Professional credit counseling gives you confidence in managing your finances and creating a clear path toward financial independence. Knowing that a structured plan is in place can offer peace of mind and reduce the burden of uncertainty. When Should You Consider Credit Counseling? You don’t have to wait until you’re in a financial crisis to seek help. Credit counseling is beneficial if: ✔️ You’re struggling to keep up with monthly payments ✔️ You have high-interest credit card debt that keeps growing ✔️ You want to improve your credit score but don’t know where to start ✔️ You’re facing calls from creditors or collection agencies ✔️ You want to develop better financial habits for the future If any of these situations apply to you, Golden Credit Latino in Dania Beach, FL, is here to help. Take the First Step Toward Financial Freedom Financial stability starts with knowledge and action. At Golden Credit Latino, our experienced credit counselors provide personalized solutions to help you manage debt, improve credit, and build a stronger financial future. Want to learn more about innovative financial strategies? Explore our blogs for expert insights on credit repair, debt management, and financial wellness.Don’t let debt control your life—take charge today. Contact Golden Credit Latino in Dania Beach, FL, for expert credit counseling and start your journey toward financial independence.

Debt Consolidation Simplifies Payments and Reduces Stress

Multiple debts with different due dates, interest rates, and payment amounts can feel overwhelming. High-interest credit card balances, personal loans, and other outstanding debts can quickly add up, making it difficult to stay financially stable. Debt consolidation simplifies repayment by combining multiple debts into a single, more manageable payment—often with a lower interest rate. Golden Credit Latino in Dania Beach, FL, provides expert debt consolidation solutions, helping individuals reduce financial stress and take control of their money. A structured repayment plan makes eliminating debt more efficient and less burdensome. How Debt Consolidation Works Debt consolidation combines multiple outstanding balances into one, making repayment easier and often more affordable. Instead of making several payments to different creditors, a single payment goes toward a new loan or program designed to streamline debt. This approach often results in lower interest rates, reduced monthly payments, and a faster path to becoming debt-free. Common ways to consolidate debt include: By consolidating debt into one payment, tracking due dates and managing interest rates becomes much simpler. Benefits of Debt Consolidation Several advantages come with choosing debt consolidation, including: Is Debt Consolidation the Right Choice? While debt consolidation provides numerous benefits, it may not suit every situation. Those who benefit most include individuals who: For those facing financial hardship and unable to make consistent payments, debt settlement or financial counseling may be better alternatives. Debt Consolidation Services in Dania Beach, FL Golden Credit Latino in Dania Beach, FL, offers professional debt consolidation services tailored to individual needs. Our specialists assess financial situations, explore options, and create personalized strategies for effective debt reduction. Contact us today for expert guidance if you’re ready to simplify your payments and lower interest rates. A clearer path to financial freedom starts with the right support. Consolidating debt into a manageable repayment plan decreases interest rates, payments become easier to handle, and financial stress is reduced. Visit our blog for more insights on debt relief, credit counseling, and economic strategies, or contact us to explore your debt consolidation options today.